Credit Checks during Order Entry

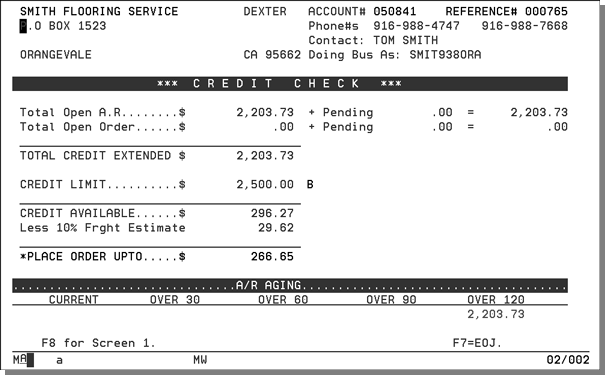

The Credit Check screen appears if your Option 2 - A/R and Credit Options allow you to view the Credit Check Screen otherwise it skips to the Header Screen. It displays credit check information for the customer whose order you are entering. This screen has no input fields. Its purpose is to perform a credit check on the account before entering a new order. This screen allows you to view the account's total open account receivables, open orders, credit limit, credit available, account receivables, and aging. A message flashes on the screen to indicate if the account is over the credit limit.

All comments and information displayed on this screen are from the Billto record for this account. The B displayed next to the credit limit is the Customer Rating field from the Billto File. Customers may be rated A (best), B, C, D (worst), T (target account), U or blank for unknown or unrated.

Following is a description of the fields on this screen.

|

Field Name |

Description/Instructions |

|

Account# |

The customer's account number and name. |

|

Reference# |

The reference number is assigned by the system at the beginning of each order entry. It appears on all documents related to the order. |

|

Phone #s |

The customer's voice and fax telephone numbers. |

|

Contact |

The primary contact in the customer's office. |

|

Doing Bus As |

An alternate name for the customer. |

|

Total Open AR |

The total current accounts receivable balance for this account. |

|

Total Open Orders |

The total open orders for this account. Open orders are orders not yet invoiced. This figure includes back orders. |

|

Total Credit Extended |

The total credit extended to a customer equals the customer's open accounts receivable in addition to the customer's open orders. |

|

Credit Limit and ABC Code |

This is the customer's credit limit, followed by their rating code (also known as the ABC code). A is for your best customers, followed by B, C, and D for your worst customers in descending order. T indicates a target account and is your competitor's best customer and should be treated as an A customer. |

|

Credit Available |

The amount of available credit. This is the credit limit less open accounts receivable and less open orders. |

|

Less 10% Frght Estimate |

This figure allows for freight and handling charges, or for other changes on existing orders. |

|

*Place Order Up to |

This is the dollar amount of credit now available to your customer. Whenever the number is negative, the screen flashes the following message: Over credit limit. |

|

A/R Aging |

This is aging of the accounts receivable for this customer. Old balances will flash on the screen |

Press Enter to go to the next screen if the credit check is acceptable. If the credit check is unacceptable, press F8 to return to Screen 1 of Order Entry.

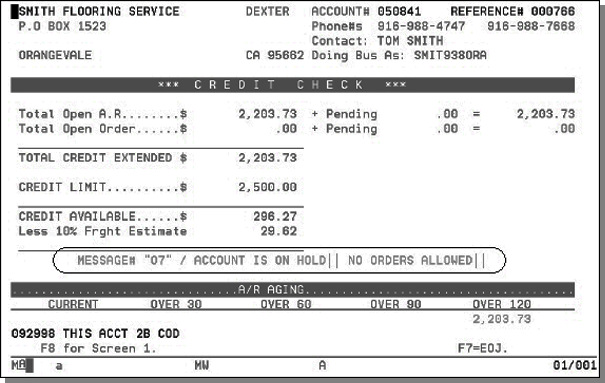

The system will not allow you to proceed past the Credit Check Screen if the customer account is on hold. An error message will appear if the account is on hold as shown in the figure below.

See the Billto File instructions for more information on credit limits and credit holds. Only the credit manager, or other authorized personnel, can temporarily remove the hold from the customer's file to allow the order to proceed. Accounts can be automatically held if over the credit limit or if they have balances a specified number of days old.

Credit checks are performed using the following formulas:

- Total credit extended to a customer equals customers open A/R plus open orders.

- Credit available equals the credit limit less credit already extended.

- Amount of existing credit equals the credit available less 10% to allow for freight and handling charges, or allow for error.

The Credit Check Screen also shows pending AR which refers to invoices entered but not yet processed, and pending orders which refer to orders entered but not yet processed.

If customers are set for after order entry credit check, then the Credit Check screen is not displayed and the order is automatically routed to the credit department if it exceeds the credit limit or other credit criteria.